China imposes % tariffs on US goods, including cotton

On April 4, 2018, the U.S. government released a list of goods subject to additional tariffs, and will impose an additional 25% tariff on 1,333 items worth US$50 billion worth of goods exported from China to the United States. This measure by the United States violates the rules of the World Trade Organization, seriously infringes upon my country’s legitimate rights and interests, and threatens China’s national development interests.

In accordance with our rights and obligations under the World Trade Organization, as well as the relevant provisions of the Foreign Trade Law of the People’s Republic of China and the Import and Export Tariff Regulations of the People’s Republic of China, with the approval of the State Council, the Tariff Commission of the State Council decided to A 25% tariff will be imposed on 106 items in 14 categories including soybeans, automobiles, and chemicals produced in the United States. The relevant matters are as follows:

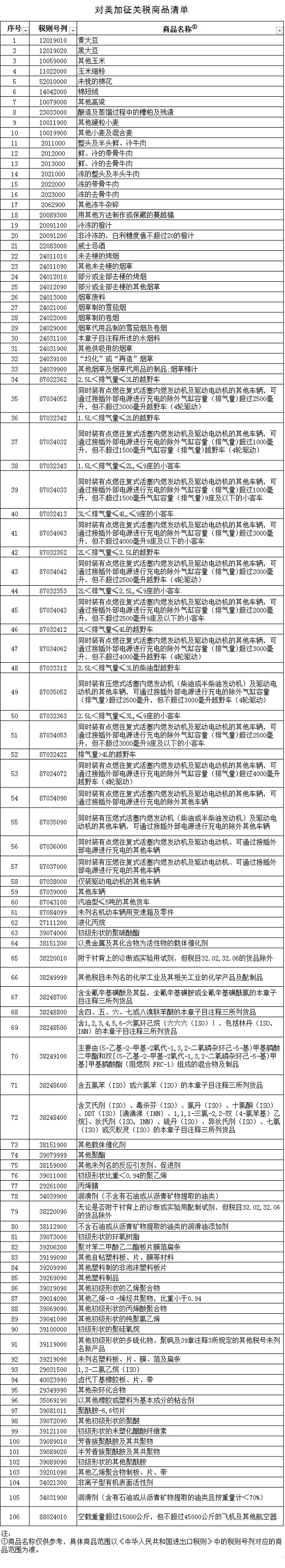

1. The goods subject to additional tariffs include 106 items in 14 categories, including soybeans, automobiles, and chemicals. Please see the attached table for details of taxation scope.

2. For imported goods listed in the schedule originating in the United States, an additional 25% tariff will be levied on the basis of the current taxation methods and applicable tariff rates. The current bonded and tax exemption policies will remain unchanged (the additional tariffs imposed this time Tariffs are not exempted).

3. The relevant import tax calculation formula after the imposition of tariffs:

Tariff = Dutiable price × (current applicable tariff rate + additional tariff rate)

Ad valorem imported goods consumption tax = Import consumption tax taxable price × consumption tax proportional rate

Compound taxable goods import consumption tax = import consumption tax price × consumption tax proportional rate + import quantity × consumption tax fixed rate

Ad valorem fixed-rate goods import link consumption tax taxable price = (duty paid price + tariff) ÷ (1-consumption tax proportional rate)

Compound taxable goods import link consumption tax price = (duty paid price + tariff + import quantity × consumption tax fixed rate) ÷ (1-consumption tax proportional rate)

Import value-added tax = import value-added tax price × import value-added tax rate

Import value-added tax price = customs duty paid price + tariff + import consumption tax

4. The implementation time will be announced separately.

Attachment: List of goods subject to tariffs on the United States and Canada

AAA

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights, please contact us and we will change or delete it as soon as possible.

AA