The new coronavirus epidemic will cause a loss of 100 million US dollars in the global garment market

According to the latest forecast from GlobalData, the COVID-19 epidemic will cause a loss of US$297 billion in the global garment market in 2020, a 15.2% decline from 2019.

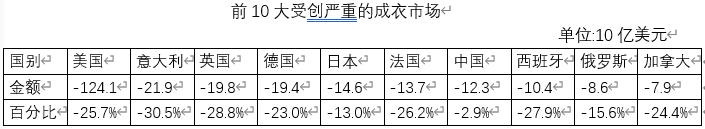

In terms of value, the ten worst-hit markets will account for 85.0% of total losses, with mature markets suffering the most, with the United States accounting for 42% of all losses. In the coming months, more major chains will file for Chapter 11 bankruptcy protection.

Despite the market’s resilience since the lifting of lockdowns and social distancing measures, this will depend on consumer confidence, the country’s reliance on tourism, the economy and unemployment. and the level of “revenge buying” (the sudden release of pent-up demand from those willing and able to spend), there is a big difference.

For example, some Chinese brand store sales have returned to 80-100% of trading levels before the COVID-19 outbreak, and garment retailers in some areas of Germany have rebounded stronger than expected. Be good. However, trading conditions in areas like Hong Kong (which relies heavily on tourism spending) are much more difficult. It is too early to assess Italy’s economic recovery, but we expect it will be a protracted process. This also applies to France, the United States, and the United Kingdom.

We expect garment spending to rebound by 17.1% in 2021, but this will not be able to make up for the lost sales in 2020. Even if some market retailers do experience consumer retaliation spending in the first few months post-lockdown, then we will see trading potentially return to 2019 levels later in the second half, which will cover 49 markets and we expect that Unable to make up for the losses incurred during the first half of the trading period. The global ready-to-wear market was worth US$1.955 trillion in 2019, and it is impossible to predict whether it will return to or exceed this level by 2022.

Note: This chart shows the 10 hardest-hit global ready-to-wear markets in U.S. dollar terms. The dollar and percentage declines indicate the difference between our revised 2020 forecast and the 2019 market size.

Mature markets have been hardest hit, and COVID-19 lockdown measures and the impact on consumer confidence will accelerate existing conditions to become more severe. Many mid-market ready-to-wear players in mature markets have lost relevance over the past decade. Retailers have failed to follow the transformation of shopping habits. The shift in consumer spending from retail to leisure has also hit their long-term prospects. The current crisis has become a The final straw for many struggling operators.

The COVID-19 epidemic has caused companies such as JCPenney, NeimanMarcus, J.Crew in the United States and the British high street brand Oasis/Warehouse to file for bankruptcy protection. However, in the next few years, As strong competitors push them out of the market, these retailers will have limited or no chance of retaining market share or the fate of being acquired. What will remain in mature markets after the COVID-19 epidemic will be a leaner mid-range ready-to-wear market, excess high street brands and shopping mall space, and a greater dominance of global fashion market leaders such as Inditex and H&M Group. .

As physical stores reopen, ready-to-wear retailers are forced to adapt to the “new normal” and safety measures in place for employees and customers will hinder their resumption of operations.

In order to comply with customer capacity regulations, there are long queues outside the store, limited fitting room space is available, and items purchased online cannot be recycled/returned (some businesses will make this mandatory) Remote/contactless practices), sterile environments and closed indoor services such as cafes or personalized shopping will discourage some consumers from going in-store. But for retailers, it is reassuring that those who do go to physical stores will spend more per person than before, as customers look to make their shopping trips worthwhile, especially as visits become more irregular. This helps offset some of the lost sales due to reduced foot traffic.

AAA flame retardant fabric mesh SDGGERY6UFGH

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights, please contact us and we will change or delete it as soon as possible.

AA